(Comme pour nous en occident, une crise, de la seule responsabilité du gouvernement chinois. Et, comme pour nous, les victimes doivent fermer leur gueule. note de rené)

China's $29 Billion Property Bailout Plan Falls Short

By Ye Xie, Bloomberg markets live analyst and reporter.

China is reportedly setting up a national bailout fund to finance stalled real-estate projects. The move, if confirmed, will reduce some systemic risk in the sector. Unfortunately, it’s neither a cure-all designed to save troubled developers, nor a game changer to turn around the market.

We have a date! Beijing set Oct. 16 as the start of the Communist Party’s twice-a-decade leadership congress, where President Xi Jinping is widely expected to retain his power for an unprecedented third term. Optimists might take the news as a positive, hoping that Beijing will improve its economic and Covid policies once the uncertainties about leadership are removed. The CSI 300 did rise in the three months following the two previous leadership changes at the party congresses -- in 2002 and 2012.

One area in desperate need of improvement is the housing market. Despite various supportive measures from Beijing, including lowering mortgage rates, the sector shows few signs of a meaningful recovery. New home sales in 30 cities fell about 22% from a year earlier in the month through Aug. 27, only slightly better than the 33% contraction in July, according to Nomura.

The government is doing more. Caixin magazine reported Monday that Beijing has set up a 200 billion yuan ($29 billion) fund -- financed by two policy banks – to help stalled property projects. It’s in-line with earlier reports from other media outlets, including Bloomberg, but contains more details.

- Local governments will borrow these special-purpose loans and complete the unfinished projects, according to Caixin. The loans will carry low interest rates of 2.8% in the first two years, but rates will jump to 6.4% if they cannot be repaid within three years. In other words, it’s not a blank check.

- Crucially, regulators have made it clear that the fund will only be used to finish stalled projects. It will not be used to stimulate the housing market or rescue developers.

- Leaving aside the question of whether it’s enough money, the plan won’t hand cash to the developers. It’s unlikely to completely break the vicious feedback loop between delayed projects, mortgage boycotts and slumping home sales.

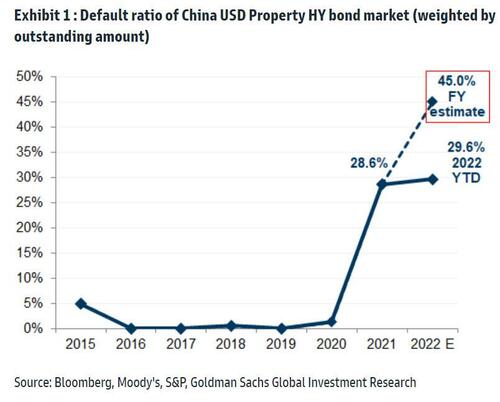

As long as home sales are depressed, more credit problems are likely. Goldman Sachs’s analyst Kenneth Ho expects the default ratio of high-yield dollar bonds by Chinese developers to rise this year to 45%, from the current 30%.

This may not topple China’s credit system as offshore bonds only account for 4% of the total debt of Chinese developers, according to Ho. By the same token, it shows why Beijing can afford to stand tough against developers.

The reported rescue plan makes it clear that President Xi is only willing to save the little guys on Main Street, not greedy and reckless tycoons.

Aucun commentaire:

Enregistrer un commentaire