(Parce que les gens sont cons. note de rené)

New OpenAI Funding Round Could Top $100 Billion, Pushing Valuation North Of $850 Billion

OpenAI's private valuation could soon top $850 billion, as the first tranche of a new funding round is expected to raise more than $100 billion, giving the ChatGPT maker fresh powder for additional infrastructure spending and faster development of its AI tools, Bloomberg reported.

People familiar with the fundraising told the outlet that the ChatGPT maker's valuation could exceed $850 billion, with a reported pre-money valuation of $730 billion.

The first phase of the funding round is being led by Amazon, SoftBank Group, Nvidia, and Microsoft, with allocations potentially finalized by the end of this month.

A second phase of funding could include venture firms, sovereign wealth funds, and other investors, potentially pushing the total fundraising even higher.

UBS analyst Aditi Samajpati told clients earlier that OpenAI's new funding round "highlights the escalating capital intensity of AI development and deepening strategic alignment between OpenAI and Big Tech."

Bloomberg hedged the report by indicating the "deal is not yet finalized and the details could change."

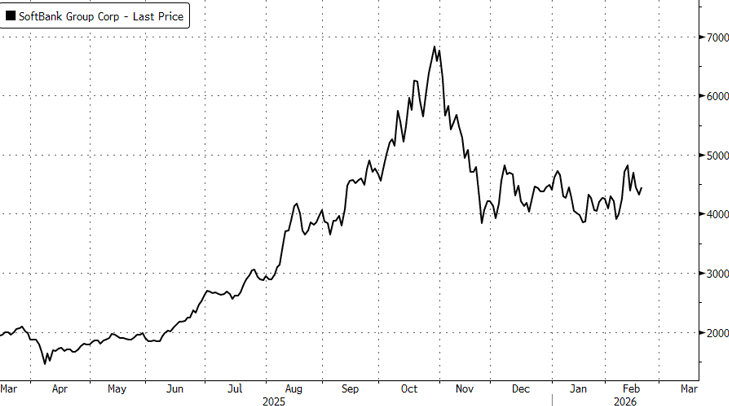

Shares of SoftBank, which held an 11% stake in OpenAI as of December, jumped as much as 4% on the news during Tokyo trading. Shares closed up 2.6% and have remained flat year-to-date after peaking in October 2025.

OpenAI's potentially stunning private-market valuation comes after Anthropic was valued at about $350 billion in its latest Series G funding round led by GIC and Coatue.

Markets are pricing in a world in which US AI giants capture an outsized share of global AI revenue, control the highest-margin layers of the stack, and retain pricing power as customers continue to pay up. The key risk we see is duration in the AI story, and this may be a harder narrative to maintain as the technological gap between US and Chinese AI models narrows.

Aucun commentaire:

Enregistrer un commentaire