(Une dette impossible à rembourser c'est une hypothèque prise sur le pouvoir régalien de l'état, ses biens et la vie des citoyens. Si on prend l'Inde et ses usuriers, nous devons travailler gratuitement pour eux, ils ont le droit d'abuser de nous et de nos femmes ou enfants et notre dette est reportée sur nos enfants jusqu'à extinction avec des intérêts impossible à rembourser qui augmentent sans cesse. note de rené)

Canadian Mortgage Debt Rises Fastest Since 2007

It probably does not need much commentary, but the rate of change that Canadians are taking out loans to purchase homes is absolutely astonishing at the moment and is reaching levels not seen since right before the 2008 housing meltdown.

New data from Statistics Canada shows the monthly changes in residential mortgage credit for June are more than double the historical average. This could only mean one thing, as we've noted in "Canadian Housing Market "Gone Berserk" As Investors Stir Bubble Fears" and ""It's Gone Parabolic": Canadian Housing In One Shocking Chart" that the Canadian housing market is boiling.

The total value of residential mortgages grew 1.2% to $1.4 trillion in June. This rate at which loans are created for residential real-estate purchases is the highest since 2007 and may soon surpass those historical levels when Statistics Canada updates the data for July/August.

Like the US, low borrowing costs and the need for more space as remote working gained momentum among white color workers during COVID was the primary driver for record home sales and prices over the last year.

But what could spoil the housing market frenzy is the Bank of Canada's (BoC) tapering of government bonds. The central bank expects to trim more of its monthly purchase this year and set the stage for a rate hike in 2022.

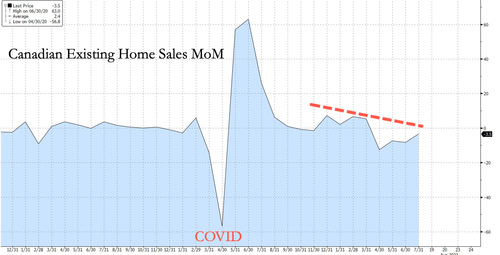

Already, existing homes sales on a month-over-month basis have slid into negative territory this summer as prices become unaffordable for many and housing shortages become more pronounced.

The housing market house of cards could come crashing down if the BoC continues to taper and hikes interest rates in 2022.

Aucun commentaire:

Enregistrer un commentaire