(Un système financier international qui ne s'appuie que sur la planche à billet comme méthode de survie ne peut conduire qu'à des soubresauts qui ruinent les économies et les peuples avec la mise en place de fascismes délirants pour ne pas perdre la main; Et l'explosion finale par l'extinction des échanges commerciaux internationaux sans que les économies réelles ne soient reconstitués dans chaque pays. Si, les démocraties veulent survivre, elles doivent réguler drastiquement le système bancaire. note de rené)

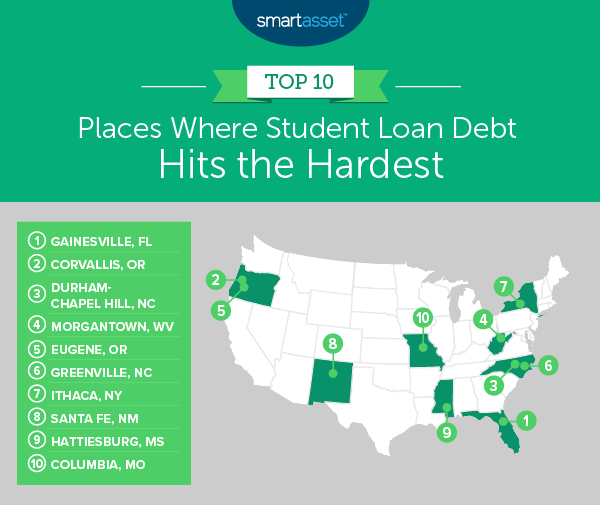

Millennials With Student Debt Are Getting Crushed The Most In These Ten Cities

SmartAsset, a personal finance technology company, has published a new study that identifies certain US metropolitan areas with the highest student loan balances.

These cities are where millennials are struggling to make ends meet and can't cover expenses. These hopeless folks have insurmountable debts, gig-economy jobs, record-high credit card rates, and no savings. Ahead of the next recession, this study provides important clues to the geographic regions where millennials will suffer the most financial distress.

The release of the study comes at a time when student loan debt has reached $1.6 trillion, has already become an important topic with presidential candidates ahead of the 2020 election, and when the next recession strikes, will financially paralyze a generation of millennials.

SmartAsset analyzed the top 25 metro areas most impacted by the student debt crisis and narrowed the list to ten.

Researchers used data from Experian, the Census, and the IRS to develop the list of where average student loan debt exceeds the median earnings of millennials.

According to the study, the top six metro areas hit hardest by the student debt crisis: Gainesville, Florida; Corvallis, Oregon; Durham-Chapel Hill, North Carolina; Morgantown, West Virginia; Eugene, Oregon and Greenville, North Carolina. The remainder are Ithaca, New York, Santa Fe, New Mexico; Hattiesburg, Mississippi; and Colombia, Missouri.

Student debt is the fastest-growing consumer debt in the country, with $1.6 trillion outstanding, cracks are already starting to appear with 22% of borrowers defaulting.

Millennials will be the most impacted generation in the next recession, and thanks to SmartAsset, the exact metro areas of this financial stress are now known.

Aucun commentaire:

Enregistrer un commentaire