(N'exagérons pas, pour l'instant la chute des ventes suit légèrement la courbe de la crise économique, -3% je crois. Les autres filières, c'est tellement pire que ce n'est pas la peine d'en parler. note de rené)

Louis Vuitton Owner LVMH Sinks As Luxury Demand Cools For Handbags, Wine, & Watches

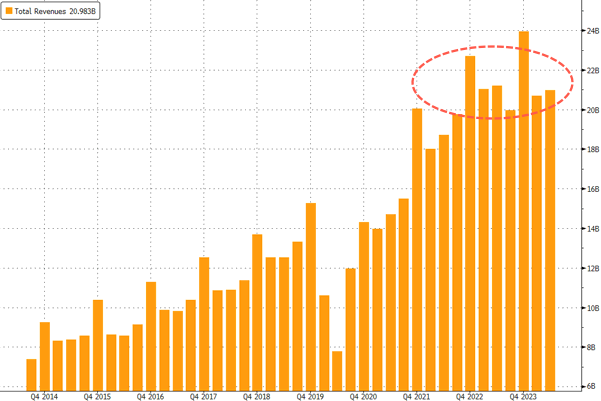

The world's largest luxury goods company reported third-quarter organic sales that missed the average analyst expectations tracked by Bloomberg. This signals a broader slowdown across luxury markets in China and the West. The results raise concerns about cost-conscious consumers as central banks reverse interest rate hiking cycles with interest rate cuts to prevent a hard economic landing in the global economy.

Paris-based LVMH Moët Hennessy Louis Vuitton, commonly known as LVMH, unexpectedly reported lower sales in the third quarter, primarily due to the pullback in Chinese luxury demand. It reported organic revenue of -3%, missing the Bloomberg Consensus of +.39%. Each division, from fashion to perfumes to watches to fine wine, missed analyst expectations. It reported revenue of 19.94 billion euros, which missed the 20.05 billion euro estimate.

Here's a snapshot of LVMH's third-quarter earnings (courtesy of Bloomberg):

Organic revenue -3%, estimate +0.93% (Bloomberg Consensus)

Fashion & Leather Goods organic sales -5%, estimate +0.48%

Wines & Spirits organic sales -7%, estimate -2.41%

Perfumes & Cosmetics organic sales +3%, estimate +4.26%

Watches & Jewelry organic sales -4%, estimate -3.71%

Selective Retailing organic sales +2%, estimate +5.09%

Revenue EU19.08 billion, -4.4% y/y, estimate EU20.05 billion

Fashion & Leather Goods revenue EU9.15 billion, -6.1% y/y, estimate EU9.74 billion

Wines & Spirits revenue EU1.39 billion, -8.2% y/y, estimate EU1.47 billion

Perfume & Cosmetics revenue EU2.01 billion, +1% y/y, estimate EU2.07 billion

Watches & Jewelry revenue EU2.39 billion, -5.5% y/y, estimate EU2.43 billion

LVMH's outlook was a dismal one that only suggests consumers in its top markets remain under pressure through year-end:

In an uncertain economic and geopolitical environment, the Group remains confident and will maintain a strategy focused on continuously enhancing the desirability of its brands, drawing on the authenticity and quality of its products, excellence in distribution and agile organization.

After the earnings report, RBC Capital Markets analyst Piral Dadhania told clients that results "indicate a more pronounced slowdown than expected."

The pandemic-era spending boom that drove luxury sales has run out of steam around the world. In the US, low/mid-tier consumers are cost-conscious and heavily indebted with depleted savings. The luxury behemoth is considered a bellwether for the entire sector.

In markets, LVMH ADRs dropped 6% late in the session, just 50bps from entering a bear market for the year.

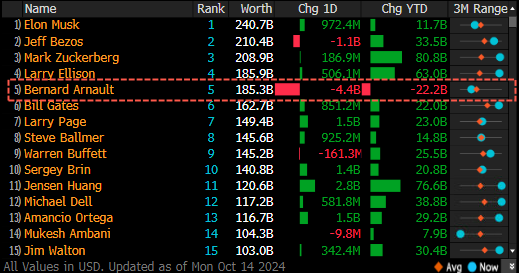

As LVMH shares decline, Bernard Arnault's luxury empire takes a hit, reducing his net worth by billions of dollars (according to Bloomberg data):

Rivals Ralph Lauren Corp., Estee Lauder Cos, and the ADRs of Gucci owner Kering SA also fell in New York as growing concerns mounted among traders that consumers were losing momentum.

Aucun commentaire:

Enregistrer un commentaire