US equity futures traded flat in the last trading session of the day, set to end a tumultuous year in muted fashion just shy of all time highs alongside global markets which likewise traded at or near record levels.

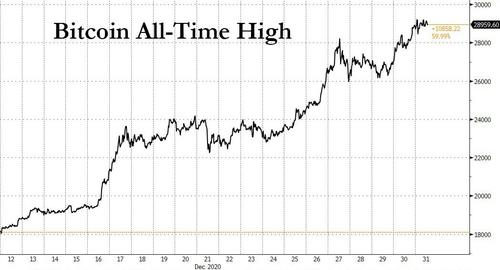

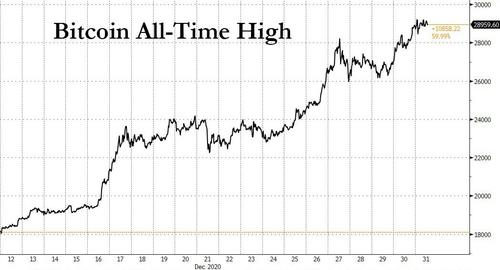

While global stock markets were muted on the last trading day of 2020 , Bitcoin’s tremendous rally this year refused to pause and rose another 0.3%, briefly surpassing $29,000, up about 50% for the month of December, its biggest monthly percentage gain since June 2019, bringing its year-to-date advance above 300%.

Stocks exposed to cryptocurrencies rose in pre-market trading on Thursday, suggesting the group will end a year of robust gains on a positive note. Among notable crypto stocks, Bit Digital rose 14% before the bell, Riot Blockchain added 5.2%, and Marathon Patent added 7.4%. All three stocks have soared alongside Bitcoin’s rally since early Oct.; in the past six months, Riot has risen more than 630% while both Bit Digital and Marathon are up more than 1,000%

Back to equities, where the MSCI World Index was down on the day as gains in Asia gave way to the losses in Europe. Despite today's weakness, the index is headed for a near 14% rise in 2020 after surging more than 60% from its March lows.

European shares fell on Thursday as lockdowns and rising COVID-19 cases overshadowed the optimism around the rollout of vaccines in the New Year, while the dollar fell to a new two-and-a-half-year low amid accelerating year-end position squaring. Trading volumes were thin, with many traders away on New Year’s Eve and major European markets closed. Where markets were open, they failed to follow their Asian peers higher. UK’s FTSE 100 fell 1.7% and France’s CAC 40 0.4%. U.S. stock futures were 0.15% lower, pointing to a weaker open on Wall Street.

Despite the recent surge, the pan-European STOXX 600, which was closed on Thursday, recorded a 3.8% drop in 2020 as a rapid surge in coronavirus cases and worries about Brexit curbed improving sentiment. Still, despite the rising COVID-19 cases and increasing unemployment, investors were betting the rollout of vaccines in 2021 will unleash an economic rebound spurred by plentiful fiscal and monetary cash.

“We still see growth slowing around the turn of the year and the recovery will still face headwinds in the coming quarters, but 2021 is shaping up to be better still than our already strong global outlook—led by a stronger U.S.,” JP Morgan economists said in a research note.

Asian stock rose on the last day of the year, heading for their fifth-straight gain and reaching a fresh record high. They were fueled by the announcement of a trade deal with the European Union and an extended rebound in Chinese internet giants. Markets were closed in several countries while a few others had abbreviated sessions. Consumer discretionary, IT and communication services were the best-performing sectors in the region, as Chinese tech giants Tencent and Meituan extended rebounds into a third day after a selloff on Monday. Chipmaker TSMC and Chinese automaker Geely were also among companies contributing the most to gains on Thursday.

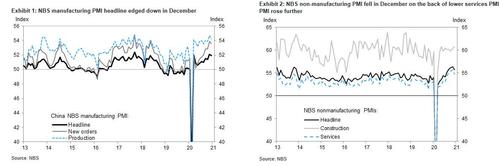

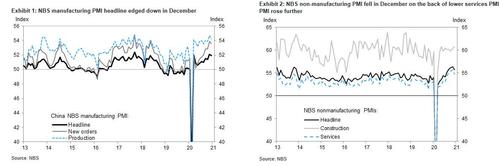

Chinese stocks were the region’s biggest gainers, buoyed on the back of manufacturing data that showed an economic recovery was still on track. On Thursday, China official NBS reported that the manufacturing PMI dipped to 51.9 in December (vs consensus exp 52.0), from 52.1 in November, while the official non-manufacturing PMI also declined to 55.7 in December (vs consensus exp: 56.3), down 56.4 in November. However, both remained solidly in expansion territory.

Australia’s stocks were the region’s biggest decliner, as a surge in virus clusters in the country’s two largest cities weighed on sentiment. Singapore stocks snapped a two-day gain after two people who came back from the U.K. were found to have the new Covid-19 strain. Markets are shut in Indonesia, Japan, the Philippines, South Korea and Thailand, while Australia, Hong Kong, New Zealand and Singapore are closed.

Of note: markets barely flickered at the news that China had approved its first COVID-19 vaccine for general public use. Natixis economist Gary Ng said the limited impact on the yuan and Chinese equities showed markets had become immune to this sort of news: “For the market to react more strongly in 2021, large-scale (vaccine) rollouts with positive outcomes are needed,” he said.

Emerging-market stocks extended their rally as optimism over global vaccine rollouts put stocks on track for their best quarter since 2009. MSCI index of developing-nation equities rose 0.4%, lifted by gains for health-care and industrial shares. The gauge is up 7.4% in December, taking its yearly advance to about 16%, the best annual performance since 2017.

In rates, US Treasuries were little changed, with benchmark U.S. 10-year yields at 0.9231% and two-year yields at 0.123%, after slight cheapening at the long end during London trading, having been closed in Asia for Japan holiday. Yields were cheaper by less than 1bp at long end with 10-year steady at around 0.925%; futures volume was around 50% of 20-day average up to 7am ET, to be expected ahead of the early 2pm close for the cash market. Month-end flows may support long end into 1pm index rebalancing, however indications are that some has already taken place.

In commodities, oil prices retreated as swelling year-on-year supply led some traders to view any economic recovery ahead to be gradual rather than swift. WTI crude shed 0.48% to trade at $48.17 a barrel, far below about $62 at the start of 2020, and Brent was trading down 0.54%, at $51.35. Gold was little changed at $1,892 an ounce. It has risen 24% this year, its best showing since 2010, as investors looked to safe havens, protection against inflation and as the dollar wilted.

Among the biggest developments in markets in 2020 has been the dramatic drop in the dollar after its harrowing March ascent. On Thursday, it hit its lowest since April 2018 and is now down 7.2% against a basket of currencies, its worst annual performance since 2017. The dollar’s weakness, driven by bets that the Federal Reserve will keep interest rates very low, has helped rival currencies. The euro has been a big beneficiary and is up 10% in 2020 and was above $1.23 on Thursday.

On today's calendar, no earnings are expected among S&P 500 members, while the only event on the economic calendar, the weekly initial jobless claims due at 8:30am, are forecast to show an increase from last

Market Snapshot

- S&P 500 futures flat at 3,723.75

- Brent Futures down 0.3% to $51.48/bbl

- Gold spot unchanged at $1,894.39

- U.S. Dollar Index down 0.05% to 89.63

- STOXX Europe 600 down 0.3% to 398.99

- MXAP up 0.1% to 200.11

- MXAPJ up 0.2% to 662.90

- Nikkei down 0.5% to 27,444.17

- Topix down 0.8% to 1,804.68

- Hang Seng Index up 0.3% to 27,231.13

- Shanghai Composite up 1.7% to 3,473.07

- Sensex up 0.03% to 47,759.19

- Australia S&P/ASX 200 down 1.4% to 6,587.10

- Kospi up 1.9% to 2,873.47

- German 10Y yield rose 0.2 bps to -0.569%

- Euro down 0.1% to $1.2284

- Brent Futures down 0.3% to $51.48/bbl

- Italian 10Y yield fell 1.4 bps to 0.433%

- Spanish 10Y yield fell 0.3 bps to 0.047%

Top Overnight News

- The European Union and China announced the political approval of an agreement to open the Chinese market further to EU investors, marking a major step in talks that began in 2013.

- Switzerland’s central bank spent 11 billion francs ($12.5 billion) on interventions in the third quarter, adding to an every- increasing tally that got the country labeled a currency manipulator by the U.S.

- Prime Minister Boris Johnson’s post- Brexit trade deal was approved by the U.K. Parliament less than 24 hours before the country’s final split from the European Union

US Event Calendar

- 8:30am: U.S. Initial Jobless Claims, Dec. 26, est. 835k, prior 803k

- 8:30am: U.S. Continuing Claims, Dec. 19, est. 5390k, prior 5337k

- 9:45am: U.S. Bloomberg Consumer Comfort, Dec. 27, no est., prior 47.0