(Tiens, donc, la FED est le problème, pas la solution. Raison pour laquelle, elle s'est acoquiné avec black rock, pour être sûr de lessiver l'économie ? Comme la banque centrale européenne d'ailleurs. black rock, vous connaissez, le patron du président français, macron, qui veut démolir les services publics en France. note de rené)

One Bank Finally Tells The Truth: "The Fed Policies Have Become Part Of The Problem"

In the aftermath of today's announcement by the Fed of 2% Average Inflation Targeting there were numerous hot takes (such as this one from Goldman) simplifying what the Fed just did: namely a "new" stance of allowing inflation to run high and the unemployment rate to run lower for longer, which according to BMO meant that the "Fed's dovishness appears to be in perpetuity." The reason: avoid any market tremors for the next five years arising out of fear that the Fed may unexpectedly tighten financial conditions if inflation suddenly gets hot.

What was not discussed is what the Fed did not say, namely that it is now compounding failure upon failure, and after 10 years of failed policies that were unable to spark higher wages (i.e., good inflation) while promoting a giant asset bubble, it will crush the living standard of the middle class further by running inflation hot even as asset prices scream to new all time highs. What was also not discussed is the Fed's role in the catastrophic economic situation the world finds itself in.

However, one banker did have to courage to address the elephant in the room, and that would be Rabobank's Philip Marey who in his Fed post-mortem "The Wrong Kind of Symmetry", writes that it took the Fed six years to describe symmetry of the inflation target in the Statement on Longer-Run Goals, noting that "while not completely irrelevant, it is the wrong kind of symmetry to focus on."

In one of the most overt criticism of the Fed we have read to date, Marey writes that "while the Fed’s step to make the inflation target "more" symmetric may benefit the wages of the average American somewhere beyond 2022, it does not really address the deeper problem with the role the Fed is playing in the US economy. It could be argued that the Fed’s policies have become part of the problem, instead of the solution." And, as the Rabobank strategist suggests, "at least this should be a topic for debate in the FOMC, instead of talking a whole year about whether to use an average or not."

To this all we would add is that the Fed should take a long, hard look at its prefered metric of core PCE: as we have repeatedly explained in recent years, the Fed continues to purposefully undercount inflation, and on top of that, it now has openly said it will disregard the politically palatable core PCE/CPI number just so it can continue blowing an asset bubble of epic proportions.

It was Marey's conclusion however that was the piece de resistance:

The much deeper problem for the US economy is the asymmetric impact of Fed policies on households and businesses. The Fed’s monetary and regulatory policies have contributed to a form of capitalism where the rewards are going to the 1% and the risks are borne by the 99%. The current crisis response has made it painfully clear again that the Fed’s policies benefit high income individuals and large corporations, while small businesses and low income individuals bear the burden. While the Fed likes to see itself as part of the solution to America’s economic problems, it should ask itself whether it is also part of these problems.

Alas, as we explained yesterday, this won't happen until the crowds of angry rioters are finally at their rightful place: in front of the Marriner Eccles building. Until then, it is just more smoke and mirrors.

We republish Marey's full must read note below:

The Wrong Kind Of Symmetry

- It has taken the FOMC six years to make the symmetry of its inflation target explicit in its Statement on Longer-Run Goals and Monetary Policy Strategy.

- The Fed’s framework review will lead to a more dovish reaction function in the long run, but hardly seems relevant in the next few years.

- What’s more, higher tolerance for inflation in itself does not cause inflation if slack is high or can’t be leveraged when it is low.

- Unfortunately, the Fed is not taking a critical look at the asymmetric impact of its policies on households and businesses. This is the kind of symmetry that may be more important

Symmetric means on average

Nowadays everything is breaking news, even when it is old news. The Chairman of the Fed is giving a speech at Jackson Hole, so it must be important. “Symmetry means on average” that was about all he had to say.

Let’s take a step back in history. The FOMC formally announced its 2% inflation target on January 25, 2012, in its Longer-Run Goals and Policy Strategy: “The Committee judges that inflation at the rate of 2 percent as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate.” While this statement implicitly indicates that the Fed’s inflation target is symmetric, this was explicitly confirmed in the FOMC minutes of the October 2014 meeting: “there was widespread agreement that inflation moderately above the Committee’s 2 percent goal and inflation the same amount below that level were equally costly.” However, the doves were pointing out that inflation had spent more time below target than above target. In particular, Narayana Kocherlakota (Minneapolis Fed) pressed for an explicit recognition of the symmetry of the target. So he finally gets what he asked for. In other words, it took the FOMC 6 (!) years to get an explicit recognition of the symmetry of the inflation target from the minutes to the Statement on Longer-Run Goals and Monetary Policy Strategy. During the Q&A at the Kansas City Fed event Powell said the Fed intends to do this kind of monetary policy review every 5 years. Does this mean that we have to wait 5 more years for the next negligible progress?

Anyway, the Fed released a revised Statement on Longer-Run Goals and Monetary Policy Strategy with the main change reflected in the following sentence: “In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.” However, Powell stressed that no exact formula will be used, so it will be ‘a flexible form of average inflation targeting.’

Does it matter?

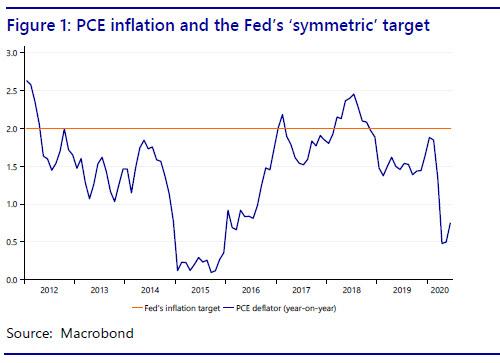

One look at Figure 1 shows that the Fed certainly has not been able to steer PCE inflation symmetrically around the 2% target. In reality, inflation has been mostly below target.

So does the explicit recognition of the symmetry of the inflation target really make a difference? In the short and medium run, definitely not. If we look at the FOMC’s own projections, they do not expect PCE inflation to get near the 2.0% target before 2023. And it may not occur soon after that with unemployment at 5.5% by the final quarter of 2022 well above the NAIRU of 4.1%. So even by their own projections this framework revision will not be relevant before 2023. Or do they expect inflation expectations to rise and cause inflation? This is very unlikely, with unemployment well above the NAIRU. Higher tolerance for inflation in itself does not cause inflation if slack is high or can’t be leveraged when it is low. While a higher inflation tolerance would allow for more wage growth, it will not create it.

In the long run it will allow the FOMC to take more time to start hiking when unemployment gets low and threatens to push up inflation. After all, the undershoot of recent years may be compensated by a moderate overshoot. This will spread employment to low-skilled people. This stands in sharp contrast to the Fed’s mistaken belief in the Phillips curve in recent years, when they accelerated the hiking cycle in 2017 and 2018 despite any evidence of low unemployment leading to wage pressures causing a wage-price spiral. So perhaps the Fed has finally learned something. The Fed’s framework review will lead to a more dovish reaction function in the long run. However, Powell already mentioned this after the June meeting of the FOMC. So nothing new here either

What really matters

It took the Fed six years to describe symmetry of the inflation target in the Statement on Longer-Run Goals. While not completely irrelevant, it is the wrong kind of symmetry to focus on. While the Fed’s step to make the inflation target ‘more’ symmetric may benefit the wages of the average American somewhere beyond 2022, it does not really address the deeper problem with the role the Fed is playing in the US economy. It could be argued that the Fed’s policies have become part of the problem, instead of the solution. At least this should be a topic for debate in the FOMC, instead of talking a whole year about whether to use an average or not.

The much deeper problem for the US economy is the asymmetric impact of Fed policies on households and businesses. The Fed’s monetary and regulatory policies have contributed to a form of capitalism where the rewards are going to the 1% and the risks are borne by the 99%. The current crisis response has made it painfully clear again that the Fed’s policies benefit high income individuals and large corporations, while small businesses and low income individuals bear the burden. While the Fed likes to see itself as part of the solution to America’s economic problems, it should ask itself whether it is also part of these problems.

Aucun commentaire:

Enregistrer un commentaire