(Les règles de libre échange établis par les oligarchies occidentales ont permis à la Chine de s'insérer dans le concert des grandes nations et d'en devenir économiquement la plus importante. Du coup, les oligarchies occidentales s'affolent de perdre leur primauté alors qu'elles croyaient soumettre la Russie et la Chine et pouvoir les piller tranquillement. Du coup comme elles ne peuvent revenir sur leurs propres règles de mondialisation des économies qui assurent leur domination, ils ne leur restent que la guerre. Mais, sont-ils sûrs de la gagner. En tout cas, nous les peuples, on est sûr de la perdre. note de rené)

The US and China tensions - rare earth minerals

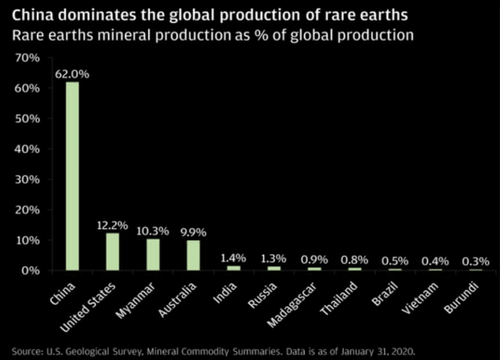

We have seen rare earth minerals in headlines lately due to (overblown?) concerns that China may limit exports as a retaliation against U.S. actions.

The collection of these 17 minerals, rare earth minerals, remains crucial to the manufacturing of various technologies; the EV race, smartphones and televisions to name a few.

There is actually plenty of rare earths, but JPM reminds us that "it is the mining and transforming of them into usable materials that is expensive and harmful to the environment. China took advantage of its low cost of labor and loose environmental laws to gain an edge in rare earth production, dating back to the mid-1980’s."

Source; JPM

So, what's the fuss about, and why has this become such a politicized question?

China absolutely dominates the production of this space and rare earths are many times seen as China’s "strategic leverage". Beijing could "easily" ban exports of rare minerals and disrupt/destroy various supply chains around the world. They have done it before.

JPM continues writing;

"As with everything else, there is a trade-off, and it seems that China has more to lose from limiting production of rare earths than it has to gain. Such action would choke off global supply chains and ultimately hit China’s economy."

If it was that easy to "shut off rare minerals", China would have probably already used that power by now.

As JPM reminds us;

"While China alluded to limiting rare earths production at the time, such threats ultimately proved to be empty. Given the US’ clear vulnerability, the Biden administration has pledged to assess rear earths independence as part of its supply chain review (recent estimates suggest that may be a decade away)."

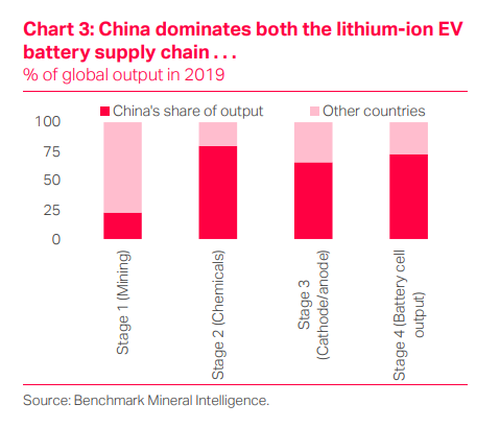

TS Lombard takes a deep dive into some of the issues of these dynamics, focusing on the EV story. They write;

"All this will intertwine core industrial concerns with national security ones, making it all the more imperative for the US to contest Chinese ambitions to lead EV/AV tech for strategic reasons amplified by perceptions of its rise. To cap off the risks, China is already in the lead in a number of key EV segments, from EV batteries to the sourcing of critical minerals and other inputs needed to produce them"

When it comes to lithium-ion batteries, China dominates 3/4 phases of lithium-ion EV battery output (for more on how to play the EV race here, basically think SQM and ALB).

Source; TS Lombard

For more The Market Ear content, exclusively on ZH premium, click here.

Aucun commentaire:

Enregistrer un commentaire