(Ca, c'est un vrai indicateur les transports maritimes de marchandises chutent pendant que l'inflation s'installe en occident. Moins de marchandises signifie aussi des marchandises plus chères. Raison pour laquelle la Chine a développé le ferroviaire et le routier avec ses routes de la soie pour ne pas dépendre d'un réseau maritime contrôlée essentiellement par la finance anglo-saxonne. Qui entre-nous est la promotrice de ce nouvel ordre mondial. Eh, oui, à la base l'idée et sa planification vient d'eux. Et, là, on peut dire que l'on va vers une inflation forte ou même à l'hyper inflation parce tout, semble-t-il, est fait pour qu'on arrive là par exemple avec la planche à billets des banques centrales occidentales, pas la russe, pas la chinoise, non, juste les occidentales et la japonaise. Mais, la japonaise, cela fait longtemps que ça dure, c'est pas nouveau. note de rené)

Shipping Containers Fall Overboard At "Alarming Rate" As Supply Chains Stretched Thin

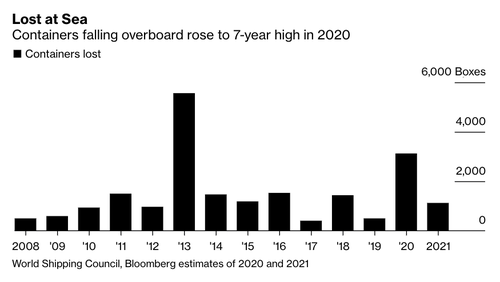

The global shipping industry is facing one of its most significant spikes in lost containers in seven years. At least 3,000 containers were lost at sea last year, and year-to-date, more than 1,000 have fallen overboard, according to Bloomberg.

Stretched global supply chains are forcing ship operators to stack truck-size intermodal containers to the brim in a technique called containerization. Some vessels, such as the notorious "Ever Given," can carry upwards of 20,000 containers, while other large containerships can carry around 9,000 containers.

"Shipping containers piled high on giant vessels are toppling over at an alarming rate, sending millions of dollars of cargo to the bottom of the ocean as pressure to speed deliveries raises the risk of safety errors. The situation has grown more dangerous because of extra stress on supply chains since the pandemic," said Bloomberg.

A combination of factors has been responsible for increasing lost containers, including overloading, unpredictable weather, and human error.

"The increased movement of containers means that these very large containerships are much closer to full capacity than in the past," said Clive Reed, founder of Reed Marine Maritime Casualty Management Consultancy. "There is commercial pressure on the ships to arrive on time and consequently make more voyages."

There were a couple of notable incidents in the last six months where one containership lost more than 1,800 containers, and another lost 750 boxes due to "rough seas." Both of these topplings occurred on busy shipping lanes between Asia and the US. China's exports have been on a tear since the US government unleashed helicopter money, and the work from home movement pulls forward the demand for cheap electronics.

Some shipping experts say besides the vessels stacked to full capacity, speed may also play a factor in topplings. It was reported by Insurance company Allianz Global Corporate & Specialty that human error contributes to at least three-quarters of shipping industry accidents and fatalities.

Jacob Damgaard, associate director of loss prevention at Britannia P&I, was quoted by Bloomberg as saying the loss of 1,000 containers this year when compared to 226 million container boxes shipped yearly is a "tiny percentage lost," adding that, "but it's almost 60% of the monetary value of all container incidents."

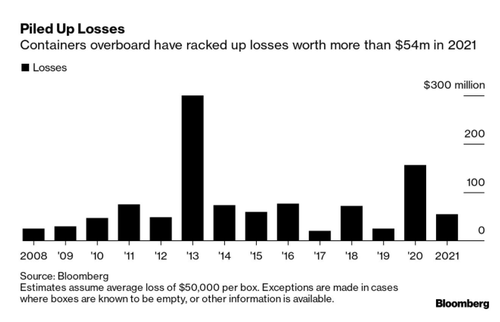

When the One Apus lost more than 1,800 containers in late November, each container was valued at around $50k on average, equating to a monetary loss of approximately $90 million, the highest in recent history, according to Jai Sharma, a partner at maritime law firm Clyde & Co. in London.

Bloomberg data shows year-to-date losses have totaled around $54.5 million.

Jonathan Ranger, head of marine Asia Pacific at American International Group Inc., said when containerships approach rough seas, captains can steer around severe weather, but the attitude is "don't go around the storm, go through."

"When you combine that with potentially poor maintenance of twist locks and cabling required to secure these boxes, then it's an accident waiting to happen," Ranger said

An unintended consequence of central banks and governments goosing the global economy with monetary and fiscal stimuli during a period of supply chain disruptions caused by the virus pandemic has resulted in busy shipping lanes and vessels stacked to the brim become top-heavy and accident-prone in heavy seas.

Aucun commentaire:

Enregistrer un commentaire