(Que voilà une bonne idée et une taxe de 60%, cela a existé aux States, me semble-t-il, surtout lorqu'un milliardaire paie proportionnellement autant de taxes et impôts qu'un simple citoyen ou pas du tout, d'ailleurs, comme ttrump. note de rené)

'Ultra-Millionaire' Tax Proposed By Warren And Other Progressives

In a move that surely won't send hundreds of billions of US dollars offshore, Senator Elizabeth Warren and Reps. Pramila Jaypal (D-WA) and Brendan Boyle (PA) have proposed an "Ultra Millionaire" tax, which would siphon 2% of the annual value of households and trusts valued at between $50 million and $1 billion. Wealth over $1 billion would be taxed at 3%.

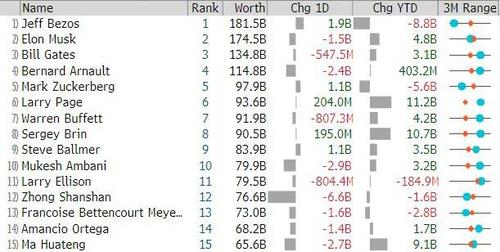

This would mean House Speaker Nancy Pelosi (D-CA) would cough up roughly $2.25 million per year on her estimated $114 million net worth. Congress's wealthiest person, Sen. Mark Warner (D-VA) would owe $4.3 million per year. Jeff Bezos, the world's richest man (again), would owe $5.5 billion per year, while many others on the world's wealthiest list also reside in the United States and would cumulatively owe tens of billions more.

According to Americans for Tax Fairness, the plan would have raised $114 billion in 2020 from the country's 650 billionaires.

On Monday, the lawmakers said the act would create a "fairer" economy.

"The ultra-rich and powerful have rigged the rules in their favor so much that the top 0.1% pay a lower effective tax rate than the bottom 99%, and billionaire wealth is 40% higher than before the COVID crisis began," said Warren. "A wealth tax is popular among voters on both sides for good reason: because they understand the system is rigged to benefit the wealthy and large corporations."

That said, this may be nothing more than more virtue signaling from Warren and her comrades, given the slim majority Democrats hold in the Senate.

A wealth tax would be difficult to pass in the current U.S. Senate, which is evenly divided between Democrats and Republicans. Democrats control the agenda, since Vice President Kamala Harris can break ties, but most bills require support from 60 senators to advance.

And Democrats have been unable to muster even 50 votes from some administration proposals, including a $15 hourly minimum wage. A wealth tax likely would be even more divisive. -Bloomberg

That said, Dems are planning to use the 'reconciliation' budget procedure to pass a massive infrastructure package which will require only a simple majority. Bloomberg suggests that once the infrastructure package is on the table, taxes to pay for it would come into focus - "And under Senate rules, tax increases generally are allowed in budget bills."

Co-sponsors of the bill include Budget Chairman Bernie Sanders (I-VT), Sheldon Whitehouse (D-RI), Jeff Merkley (D-OR), Brian Schatz (D-HI), Ed Markey (D-MA) and Mazie Hirono (D-HI).

Once wealth taxes are normalized, we can only imagine how low Democrats will go with income brackets.

Aucun commentaire:

Enregistrer un commentaire