(Bon les banques centrales à force de renflouer les banques privées, de les tenir à un haut niveau de rendement grâce à l'argent magique de la planche à billets se sont ruinées. N'oublions pas que tout l'argent injecté pour les sauver est l'argent qui manque pour développer les services publics et les ruinent puisque NOTRE argent qui aurait dû servir à les développer à été détourné par l'état censé nous protéger. Pourquoi, me demandez-vous ? Parce que la dette est la nôtre pas la leur, un joli tour de passe passe, n'est-il pas ? note de rené)

"The Fed Is Broke" - Gundlach Likes Gold, Fears "Expanding Wars" Most

In the past week, DoubleLine CEO and founder Jeffrey Gundlach has had a lot to say as the US banking system collapse and bailout enjoins Europe's banking crisis leaving central banks' inflation-fighting plans in question.

The ECB was clear - hiking 50bps and FTW! - but what will The Fed do?

The market has dovishly adjusted to the banking crisis overhang... (pricing in a peak in rate in May with just one 25bps hike and then cuts for the rest of the year)

...and the new 'bond king' suggests that Powell hikes continue to keep up its inflation-fighting efforts, due to credibility concerns.

“This is really throwing a wrench in [Fed Chair] Jay Powell’s game plan,” Gundlach said.

“I wouldn’t do it myself. But what do you do in the context of all this messaging that has happened over the past six months, and then something happens that you think you’ve solved.”

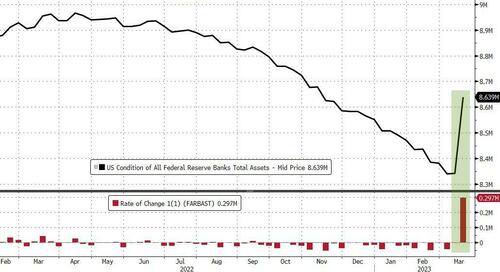

Ironically adding that, The Fed is doing this with one hand at the same time as enabling inflationary policy with the BTFP on the other:

“I think that the inflationary policy is back in play with the Federal Reserve … putting money into the system through this lending program.” Gundlach said.

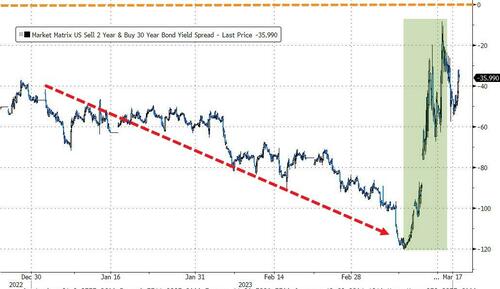

But, in a Twitter Spaces audio chat Thursday with Jennifer Ablan, editor-in-chief of Pensions & Investments, Gundlach warns of an imminent recession - within the next four months - as the yield-curve suddenly steepens...

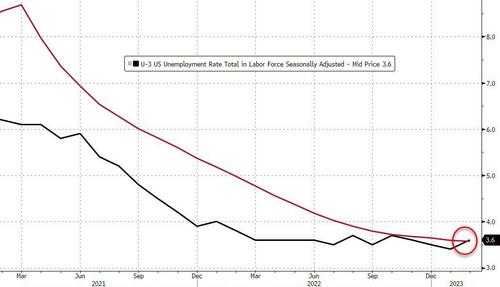

"In all the past recessions going back for decades, the yield curve starts de-inverting a few months before the recession," adding that "I think it's within four months at the most. Almost every indicator is flipped into high probability. The only one that hasn't is the unemployment rate."

But,, the DoubleLine founder pointed out that at 3.6%, the unemployment rate just crossed back above its 12-month moving average...

Which, historically has been "a reliable indicator you're on the doorstep" of recession.

Gundlach called Silicon Valley Bank's failure "a rate policy collision with stupid accounting rules" for banks, but warned of The Fed's reaction was inflationary and antithetical to their inflation-fighting stance.

"By bailing out depositors at SVB, that's essentially a quantitative easing" by the Fed, he said.

"Making those depositors whole is about the same as a month or two of reversing quantitative tightening."

The stock market is currently in a bear market, he said, and he would sell into any rallies.

Gundlach predicts the S&P 500 index will trade down to 3,200 and reminded investors that "the goal for 2023 is survival, and losing as little money as possible."

What worries the bond king the most may surprise some - spreading geopolitical conflicts:

"I think expanding wars worries me the most."

But he was clear on the biggest financial risk:

"The Fed is broke. The Fed's balance sheet is negative $1.1 trillion. There's nothing they can do to fight any problems except for printing money.

They have nothing left. The Fed used to send money to Treasury. Now Treasury sends money to the Fed.

We're at this point in time where we don't have any road left to kick the can on our mismanagement of finances and monetary policy."

His suggestion - buy gold.

If government spending continues, he predicts "the dollar will collapse under the weight of the deficit."

"I think gold is a good long-term hold, gold and other real assets with true value, such as land, gold and collectibles."

Aucun commentaire:

Enregistrer un commentaire