(Vite, vite il faut numériser la monnaie pour éviter l'effondrement du dollars et faire payer le coût aux bêtes européens. note de rené)

Russian 'De-Dollarization' Escalates: Begins "Strategic" Plan To Buy Billions In "Friendly" Currencies

Ever since March 2018, when Moscow dumped practically all of its US Treasury holdings, Russia has been at the forefront of a global process of 'de-dollarization'. Practically speaking, reducing the nation's dependence on the global hegemon's control of payments and thus everything else.

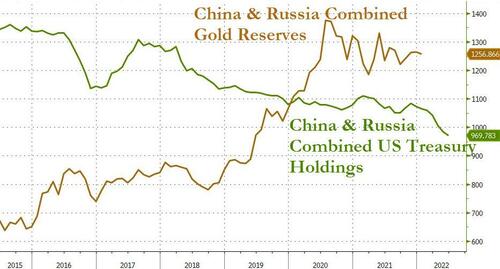

China joined the fight more recently but has been increasing its gold reserves while reducing its US Treasury reservesquite consistently for over two years.

Of course, all of that 'normal' process has been thrown into chaos since Putin invaded Ukraine with sanctions, bans, and virtue-signaling by Washington curb-stomping the freedoms of many so-called 'friendly' nations to Russia (and some un-friendly who simply prefer to feed/heat/cool their citizenry than fall in line).

Since the invasion, the 'Ruble is rubble' narrative has been crushed after initial weakness in the Russian currency reversed to massive strength amid soaring energy prices (and energy-for-Rubles agreements)...

All of which brings us to a stunning new report from Bloomberg that Russia is considering a plan to buy as much as $70 billion in yuan and other “friendly” currencies this year to slow the ruble's surge.

“In the new situation, accumulating liquid foreign exchange reserves for future crises is extremely difficult and not expedient,” a presentation on the proposal prepared for the meeting said.

For years, the Kremlin contained spending and saved hundreds of billions in dollars, euros and other foreign currencies as a cushion to insulate the economy from the ups and downs of oil prices.

“The frozen $300 billion were of no help to Russia; on the contrary, they became a vulnerability and a symbol of missed opportunities,” the presentation said, in a rare official admission of the true impact of sanctions.

Bloomberg saw a copy of the document, which isn’t public, and the people familiar with the meeting confirmed its authenticity. The government and central bank didn’t immediately respond to requests for comment on the plan.

According to people familiar with the deliberations who spoke on condition of anonymity to discuss matters that aren’t public, the plan won initial support at a special “strategic” planning meeting of top government and central bank officials including Governor Elvira Nabiullina on Aug. 30.

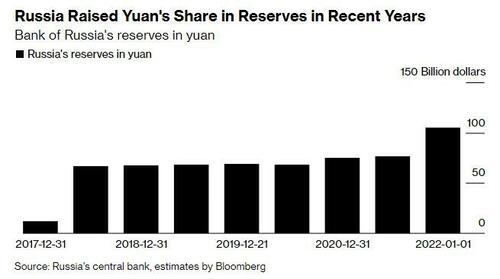

With earnings from exports of oil and gas flooding in and driving the current account surplus to a record this year and pushing the ruble higher, the proposal calls for spending 4.4 trillion rubles ($70 billion) to buy the currencies of “friendly” countries, mostly yuan...which it has been gathering for a couple of years...

Alexander Isakov, Bloomberg's Russia economist noted that "the purchases will help Russia cap unprecedented real-exchange-rate strength, which is hurting exporters and the budget’s commodity revenues. For neutral countries, these purchases will bring some support for local currencies, help fix their current account issues and help fund commodity imports."

So, as CFR senior fellow Brad Setser notes, the Russian Central Bank could become the first big central bank to hold the bulk of its reserves in emerging market currencies.

Currencies of 'friendly' currencies like offshore Yuan, Turkish Lira, and India's Rupee all caught a bid on the report earlier in the day.

As Ruchir Sharma recently noted, reflecting on the false security many are getting from seeing a strong dollar, the impact of US sanctions on Russia is demonstrating how much influence the US wields over a dollar-driven world, inspiring many countries to speed up their search for options. It’s possible that the next step is not towards a single reserve currency, but to currency blocs.

Setser adds that "the real lesson of Russia isn't about the dollar (or euro). It is that excess reserve holdings of all G-7 currencies may not be as strategically valuable as thought."

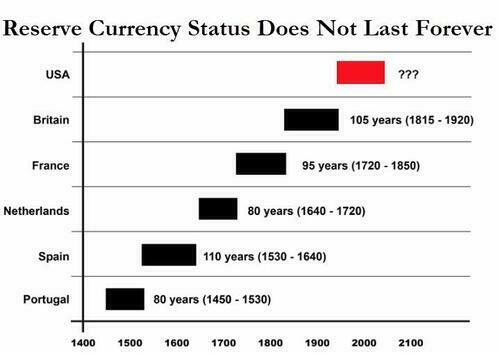

As Banque de France noted in a July article, recent geopolitical tensions have put the hegemonic role of the dollar, and its potential demise, back into the spotlight. Looking at a new long run measure of global currency competition over two centuries, no global currency leader has been able to sustain such a large lead over its competitors for such a prolonged period.

Remember, nothing lasts forever...

Since the 15th century, the last five global empires have issued the world’s reserve currency - the one most often used by other countries - for 94 years on average. The dollar has held reserve status for more than 100 years, so its reign is already older than most.

Aucun commentaire:

Enregistrer un commentaire