Why Markets Are Calm As Taiwan Tensions Intensify

By Ye Xie, Bloomberg markets live commentator and reporter

Despite rising tensions between the world’s two most-powerful countries over US House Speaker Nancy Pelosi’s possible visit to Taiwan, global risk markets have been quite resilient.

That fits the historical pattern since markets often struggle to handicap geopolitical risks pre-emptively. Investors may also take comfort that market reaction to geopolitical events tends to be short-lived. Either way, we are in unchartered territory, and these risks increase the appeal of bonds in both countries.

Earlier this year, the Economist called Taiwan the “most dangerous place on Earth” in one of its cover stories. So reports about Pelosi’s potential landmark visit and angry protest from Beijing naturally put people on edge. The White House briefed reporters about possible responses from China, including firing missiles into the Taiwan Strait, launching new military operations, crossing an unofficial no-fly zone between Taiwan and the mainland and making “spurious” legal claims about the strait.

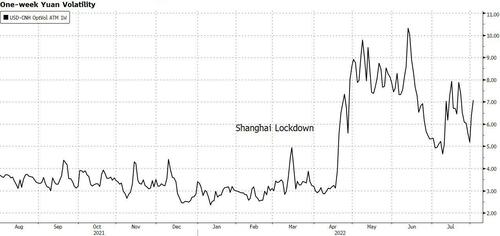

Yet global markets have largely dismissed it as a non-event. While the yuan weakened 0.5%, its one-week volatility was largely muted. ADRs of Taiwan Semiconductor Manufacturing Co., the world’s largest chipmaker, barely moved; neither did the S&P 500.

It’s not the first time that markets have remained relatively calm amid rising geopolitical risks. Despite weeks of military buildup on the Ukraine border, markets generally underestimated the risk of Russia’s invasion. It underscores the difficulty investors face when trying to price in the risk of wars.

Bhanu Baweja, UBS’s chief strategist, did recommend his clients hedge the risk of the Russia-Ukraine war before Putin eventually invaded, a call that proved to be prescient. He says the situation in China is different. First, the timeline of a possible confrontation over Taiwan is less clear cut than it was with Russia’s attack, making hedging more difficult.

In addition, foreign investors have pulled out of China’s bond market and inflows to stocks have diminished since Russia’s invasion sparked concern about potential secondary sanctions against China. The need for hedging is less so. It’s more of a slow-burning situation than a cut-and-run, he said.

Investors also may be lulled into complacency by past experiences. “People are numbed. People do expect some non-negligible risk of Pelosi visiting and China reacting poorly ... i.e. a lot more war planes over, and military exercises near, Taiwan,” said Jason Hsu, chief investment officer at Rayliant Global Advisors. “But that’s not new and have historically not led to actually conflicts.”

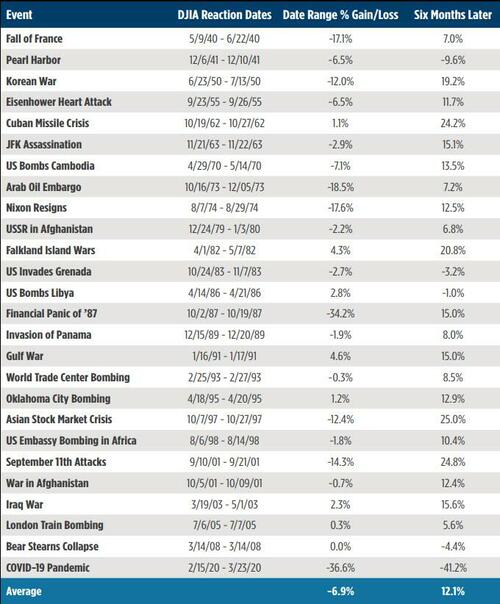

Finally, markets’ reactions to geopolitical risks tend to be short-lived. For example, US stocks actually increased during the Cuban missile crisis and rallied even more in six months.

Source: Amundi

Of course, that markets haven’t preemptively reacted doesn’t mean the risk is gone and that investors won’t sell later. If anything, these developments reinforce the rationale for the current bond rally since investors are already concerned about a potential recession.

Aucun commentaire:

Enregistrer un commentaire