(Le bitcoin est investi par les pires spéculateurs financiers, il est temps de se rapatrier sur d'autres crypto-monnaie. Le profit à court terme, c'est bien, mais, préserver son capital en le faisant fructifier, c'est mieux. note de rené)

Ethereum Surges Above $3,000; Now Bigger Than BofA & Disney

In the immortal words of Ron Burgundy, "that escalated quickly."

In 15 calendar days, Ethereum has gone from sub-$2000 puke to being over $3000 ($3028 highs)...

Source: Bloomberg

Ether has quadrupled year-to-date (dramatically outperforming bitcoin, which itself has put in a none-too-shabby double YTD)...

Source: Bloomberg

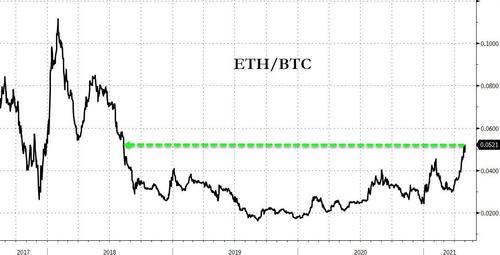

ETH is now at its strongest relative to BTC since Aug 2018...

Source: Bloomberg

As CoinTelegraph notes, the remarkable run has even prompted renewed speculation that Ethereum could “flippen” Bitcoin, overtaking BTC as the largest digital currency in the world.

The first time we detailed Ethereum's potential was in February 2017 (when ETH was at around $13)...

"Because of its capacity for smart contracts — and other complicated computing capacities — Ethereum is viewed as more agile and adaptable than Bitcoin."

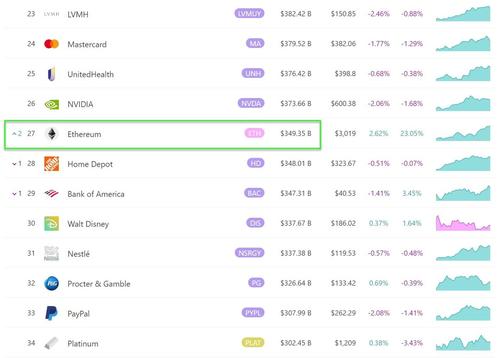

Ethereum is now bigger than Bank of America, Disney, and Home Depot:

There are multiple catalysts behind Ethereum’s rise, as CoinTelegraph details:

The first is an ongoing surge in activity on the chain, including from institutional entities: earlier in the week the European Investment Bank announced it would be issuing a two-year digital bond worth $121 million in collaboration with banking entities such as Goldman Sachs.

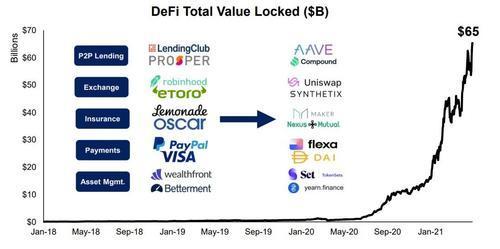

Retail interest in DeFi has also been rising as of late, with total value locked numbers reaching astonishing highs above $100 billion.

However, the “London” hardfork, which includes the EIP-1559 overhaul of Ethereum’s fee structure, as well as the subsequent looming ETH 2.0 transition to a proof-of-stake consensus model, may be the prime events investors are anticipating. These upgrades to the network are expected to significantly decrease fees, as well as reduce the amount of ETH rewarded to miners - which in turn is expected to decrease sell-side pressure on the asset.

Billionaire Mark Cuban offered an interesting thread on the entire crypto-space this evening:

Crypto succeeds when it's a more productive implementation of it's competition.

BTC/Gold are both financial religions.

BTC is easy to trade/store/create with no delivery issues. BTC also enables transfer of value locally and globally . Gold is a hassle.

Just look at Ft Knox

Eth Smart Contracts are better, cheaper, faster at authenticating/buying/selling/delivering digital items than alternatives available. This makes it a viable currency and trading mechanism for all things digital. That's powerful and will grow as applications are added

Eth Smart Contracts for De-Fi are better at enabling depositing/saving/trading of financial instruments than banks. One is automated and trustless and near immediate. The other is dependent on buildings full of people who add cost and friction to the same transactions

Where alt coins can offer rewards to their holders because they gain revenue for the more productive service they offer, they can succeed with enough users. It is VERY COMPETITIVE. Barriers to entry are minimal. Which is the risk to all participants. But rewards better solutions

Meme coins like Doge only work if they gain utility and users use them for that utility. As long as you can spend Doge , because we know it's annual inflation rate is set at 5b coins, it can gain SOME value as the utility grows. It becomes like any other currency...

As long as more companies take doge for products/services, then Doge can be a usable currency because it MAY hold its purchasing value better than a $ in your bank. If interest rates skyrocket or the amount spent falls or stagnates, so will Doge. Yes, a joke is now legit

Crypto not just about being more productive and effective, but also no longer dependent on "trusted institutions" Ask PPP applicants how much they trust their big banks? Do you trust your health insurer?. Crypto is trustless and a better way to handle many transactions.

So when someone says they don't get why crypto assets have value. Show them this.

Between the enormous amount of activity on Ethereum, the economic improvements to Ether, and the promise of increased scalability with Ethereum 2.0, there is a lot for the Ethereum community to be excited about.

Finally, we note that FundStrat's Tom Lee maintains his $10,500 target for Ethereum as we detailed here(and suggests the possibility of a $35k target).

Aucun commentaire:

Enregistrer un commentaire