lundi 15 décembre 2025

Rabbi killed in Sydney attack encouraged Israel’s genocide in Gaza; Report says

December 15, 2025 at 12:37 pm

Rabbi Eli Schlinger, who was killed in an armed attack in Sydney on Sunday, had previously visited Israel and met with Israeli soldiers, encouraging them to continue the war of genocide against the Gaza Strip, an Israeli television channel and an Israeli activist have revealed.

Schlinger was among 12 people killed and at least 29 others wounded during an armed attack that took place during Hanukkah celebrations at Bondi Beach in Sydney, according to Australian authorities. The Israeli Broadcasting Corporation (Kan) confirmed that Schlinger was an emissary of the Chabad-Lubavitch movement in Australia.

Israeli activist and journalist Hanoch Daom wrote on Instagram that Schlinger travelled to Israel following 7 October 2023, where he met with Israeli soldiers to offer what Daom described as “support and encouragement” during the ongoing military campaign in Gaza.

READ: Trump praises Muslim man Ahmed Al-Ahmad for stopping attacker in Sydney

Israel’s Channel 12 later broadcast an image showing Schlinger sitting among Israeli soldiers atop a military vehicle. The broadcaster did not clarify where or when the photograph was taken, nor whether it was inside the Gaza Strip.

Schlinger’s social media accounts show that he used the image of himself with Israeli soldiers as his profile picture on both Facebook and Instagram, openly expressing support for the Israeli army.

The Chabad-Lubavitch movement has long rejected Palestinian national rights and opposes any political settlement that would grant Palestinians sovereignty over occupied territory.

Israel’s genocide in Gaza has, for more than two years, resulted in the killing of over 70,000 Palestinians and the wounding of more than 171,000 others, most of them women and children, according to Palestinian health authorities and international organisations. The campaign has triggered widespread international condemnation and deepened Israel’s global isolation.

(L'enthousiasme a été fabriqué par les médias pour initié une bulle financière. note de rené)

... et plus précisément si les coûts de développement de cette technologie seront compensés par les gains de productivité qu'elle peut engendrer.

Enthusiasm For AI Stocks Is Finally Being Replaced By Questions

By Jane Foley Senior FX Strategist at Rabobank

Perhaps inevitably, the enthusiasm for AI related stocks in the past few years is now being replaced by questions regarding the returns on investment and specifically whether the costs of developing the technology will be matched in terms of the productivity growth it can create [ZH: actually, no: those questions emerged first last summer, but have been swept under the circle-jerking rug every single time].

The tail-end of the week brought further evidence of investors rotating into cyclical stocks. This had pushed the S&P 500 to a fresh record high at Thursday’s close as the market absorbed last week’s ‘as expected’ 25 bps Fed rate cut and its upward revision to US GDP forecasts. The slew of US data releases in the week ahead will be a strong determinate in how sentiment develops in the final weeks of the year.

In an interview with the WSJ on Friday, President Trump indicated that both Warsh and Hassett remain in the running for the job as the next Fed Chair. Trump reportedly commented that he thought the next Fed Chair should consult him on interest rate policy, though Hassett over the weekend remarked that the job of the Fed is to be independent.

The releases of Chinese retail sales, production, investment and home price data have already kicked off a heavy data week. Retail sales have disappointed with a weaker than expected 1.3% y/y upturn in November - the weakest reading since the pandemic. Chinese fixed asset investment also disappointed at -2.6% y/y ytd, which puts it on track to post the first full year drop since 1998. The weakness in property investment and new home prices compounded the weak tone and underpinned concerns about the challenges facing the Chinese economy in 2026.

Ukraine President Zelensky conceded over the weekend that the country would be willing to give up its long-term goal of Nato membership if security guarantees from the US and Europe were a way to prevent future Russian aggression.

US President Trump has issued Kyiv with a Christmas deadline to accept a peace deal. US Special Envoy Witkoff and Kushner, Trump’s son-in-law, arrived in Berlin yesterday for talks with Zelensky and German Chancellor Merz. The EU 27 will sit down for a summit on Thursday to discuss Ukraine, defence and its multiannual financial framework.

Week ahead

While the market consensus sees scope for another 50 bps of Fed rate cuts in 2026, the majority of G10 central banks are now expected to be tightening policy by the end of next year. Alongside the Fed, market pricing is also pointing to a 50-bps reduction in BoE rates by the end of 2026 in addition to 25 bps more easing by the Norges Bank. There is still a slight suspicion in the market that the SNB may return to negative rates next year. By contrast all other G10 central banks are expected to hike policy. At the start of last week, the ECB’s Schnable encouraged market hawks by her suggestion that she was comfortable with market bets on rate hikes. It is hoped that the rhetoric from the December 18 ECB policy meeting will bring some clarity to this view, though in terms of the policy announcement, a steady outcome is universally expected from the ECB this week. Indeed, it is Rabobank’s view that further easing this cycle would require a material downside surprise. For now caution will likely prevail, while policymakers continue to evaluate the impact on the Eurozone economy from US tariffs, France’s budget challenges and the competitive issues faced by Germany – not least this year’s firmer exchange rate. Although we expect steady policy throughout 2026, we have pencilled in two potential rate hikes in 2027 from the ECB.

Steady policy is also expected from the Norges Bank on December 18, although further easing has been signalled by Norwegian policymakers this cycle. Steady policy is also expected to be on the cards from the Riksbank on the same day, though Sweden could be in the running to be the first G10 country to see a rate hike this cycle. A rate cut is widely expected from the BoE on December 18.

Friday’s release of UK October GDP data disappointed the market with a weaker than expected -0.1% m/m print. The UK has now failed to see any growth for four consecutive months. The data underpinned fears that uncertainty leading up to the UK’s November budget created a drag on confidence and activity levels. At the November 6th BoE policy meeting there was a 5:4 vote in favour of steady rates. Governor Bailey is widely expected to switch sides and vote alongside the doves this week. That said, while UK CPI inflation appears to have peaked, the headline number at 3.6% y/y, is still showing signs of stickiness. This suggests that some element of caution can be expected from the MPC.

The other G10 central bank scheduled to vote on policy this week is the BoJ on December 19. The market now strongly expects a 25-bps hike. This marks a sharp shift in sentiment since, as recently as October, Takaichi’s appointment as PM had sparked widespread fears that she would lean on the central bank not to tighten policy. Last week Governor Ueda remarked that Japan had weathered the shock of US tariffs well and, in an interview with the FT, he expressed some confidence about the rise in underlying inflation towards the BoJ’s 2% target. The overnight release of Japan’s Quarterly Tankan report shows business confidence amongst large manufacturers improving to its best level in four years in Q4 – a reading which will have solidified market hopes for more BoJ rate hikes. Japanese November CPI inflation and December PMI data will be released this week ahead of the BoJ’s policy announcement.

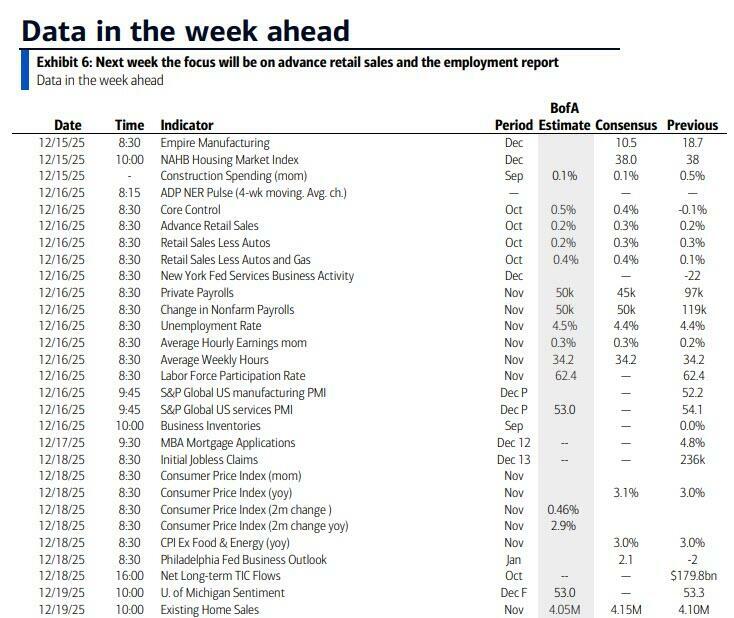

A slew of US data is due out this week as officials continue to make good the absence caused by the government shutdown. The market median points to a 50K gains in Tuesday’s November non-farm payrolls release combined with an unemployment rate of 4.5%. The data follow last week’s robust US export numbers, which had positive implications for US Q3 GDP. Tomorrow will also bring US October retail sales data and December PMIs. Other US releases this week include the December Philly Fed index, initial claims and November existing home sales. Plenty of Fed speakers are also slated this week. UK releases include Labour data and the November CPI inflation report. The latter is expected to show further signs in easing in UK price pressures, which would solidify market expectations for a BoE rate cut on December 18. UK November retail sales are due at the end of the week. PMIs plus Germany’s ZEW and IFO releases will ensure a European theme is included in this week’s data surge, while Canada will see a fresh CPI inflation report. In Australia, PMI data and consumer confidence numbers are due.

Les fabricants de vaccins feraient faillite sans immunité juridique, concède un ancien directeur du CDC

Vaxx Producers Would Go Bankrupt Without Legal Immunity, Concedes Former CDC Director

Originally published via Armageddon Prose:

Bioterror Propaganda Roundup: The latest updates on the “new normal” — chronicling the lies, distortions, and abuses by the ruling class.

Former CDC Director defends full immunity for vaxx manufacturers

Once in a blue moon, these demons accidentally let some truth slip from their lying lips.

Unindicted COVID criminal Rochelle Walensky recently appeared for a “Fireside Chat” with the Boston Globe to justify the special privilege granted exclusively to the pharmaceutical industry, in which Americans mutilated and murdered by its vaccine products have no legal recourse to collect damages:

“One final thing is the Vaccine Injury Compensation Program. We acknowledge there are true, albeit rare, injuries associated with vaccines… Those people should merit some compensation*... In order to keep both our physicians and our manufacturers* free of the responsibility for them, for those very rare injuries, there is this program that compensates people for them. And that program is at risk right now. And in the absence of that program, we may see manufacturers... choose not to make vaccines.”

*“Some compensation.” When Pfizer kills your kid with a product it only pushed to market because it bribed regulatory officials and rigged trial data, you deserve “some” compensation, Walensky says. Not enough to actually make up for the death of a child or incentivize better behavior from the pharmaceutical industry with a fine that actually hurts its bottom line, but “some” compensation — some nominal pittance, just to shut you up.

**This might slip by most people’s notice, and this might come off as semantical quibbling, but note the use of the qualifier “our” manufacturers. This bitch markets herself as a career public health official working in the interest of the public; why does she use the possessive determiner “our”?

VIDEO

Per Statista, the United States market alone accounts for $27 billion dollars in annual revenue to the vaccine industry in 2025. By 2030, if trends continue, that figure will soar to $40 billion.

If, as Walensky claims, vaccine injuries are “very rare,” there is no reason that a $40 billion industry can’t absorb liability for the damages it causes.

If, however, as is actually true, they aren’t “very rare,” and victims have the right to prove their injuries in tort court like they can with literally any other consumer product, of course the payouts for the very real damages would threaten the industry’s bottom line. These corporations deserve to be sued into oblivion, and they definitely would be if they had to play by the same rules as any other corporate entity — the subtext of Walensky’s pharma apologism above.

Related: WATCH: Pfizer CEO Flops Attempting to Defend Vax Liability Shield

-----------------------------------------

[If you appreciate Armageddon Prose, please consider a $5/month or $50/year Substack subscription or a one-time digital “coffee” donation. For alternative means of patronage, email benbartee@protonmail.com.]

------------------------------------------

United Airlines CEO still defending COVID vaxx mandate in 2025

“I did it before it was political. And we did it for safety. So, you know, safety is number one at an airline. And it was pretty clear, it is clear, that it was safer. And I looked at it as, nobody has to get a COVID vaccine. I don’t think we should tell anyone they have to. But if I’m going to tell you you have to sit in a cockpit next to someone, it’s not fair to the other person… It was purely a safety issue for us. ”

VIDEO

“Purely a safety issue”!

Does this dirtbag not know that the COVID shot never prevented transmission — and was never even tested for transmission prevention — thereby negating any legitimate claim of “safety” as the pretext for a mandate?

Or does he simply not care?

In either case, one with any sense of decency or humility is forced to marvel at the hubristic spectacle of such a creature, asserting with full confidence in full contradiction of reality, industry talking points that have debunked for years.

Of course, claims of “safety” notwithstanding, the real reason, or at least a major reason among several, for the airlines’ mandates was the threat of the government revoking government contracts if they did not comply with the Brandon entity’s pseudoscientific 2021 executive order when insufficient volumes of the peasants, even after being bribed with free doughnuts and lapdances, still refused to submit to the needle.

Benjamin Bartee, author of Broken English Teacher: Notes From Exile (now available in paperback), is an independent Bangkok-based American journalist with opposable thumbs.

Follow AP on X.

Subscribe (for free) to Armageddon Prose and its dystopian sister, Armageddon Safari.

Support AP’s independent journalism with a one-off, hassle-free “digital coffee” tip.

Bitcoin public address: bc1qvq4hgnx3eu09e0m2kk5uanxnm8ljfmpefwhawv