(Une récession pire qu'attendue. note de rené)

A Lone Bank Doubles Down On Its Doomsday Call, Says Recession "Will Be Worse Than Expected"

Three weeks ago, Deutsche Bank shocked the polite world of finance - where nobody dares to tell the truth if the truth is unpleasant and runs counter to the commission-boosting bias of being bullish on everything - when it became the first Wall Street bank to officially make a US recession in late 2023 its base case (here we of course exclude such uber-bears as BofA's Michael Hartnett or SocGen's Albert Edwards, who have pitched recessionary scenarios explicitly different from the banks' bullish "base cases").

Then last week, the bank doubled down on its shock factor when it came out with an even more bearish view in its latest "House View" note, in which the bank' top economist explained that not only is a recession assured but that inflation expectations "will likely move significantly higher, ultimately leading to an even more aggressive tightening and a deeper recession with a larger rise in unemployment" which in turn will mutate into the outcome the Fed has been so desperate to avoid: a hard landing.

Fast forward to today, when DB has gone for the Trifecta and its head of research and chief economist David Folkerts-Landau, alongside chiefs of economic and thematic research Peter Hooper and Jim Reid, published a must-read piece (available to professional subscribers in the usual place) in which he makes two points:

i) how can it be that Deutsche Bank is the only "extreme outlier" that has recession as its base case for 2023 when "given the macro starting point, the burden of proof should be on why this boom/bust cycle won’t end in a recession", and

ii) having previously argued that higher inflation was going to be the defining macro story of the decade, the bank now discusses how Fed Funds and the ECB rate will likely have to go higher than the consensus believes and that, as a consequence, "the upcoming recession will be more severe than even our outlier House view forecast."

Addressing the first point first, DB says that it is surprised that of the 75 professional forecasters on Bloomberg, the bank's House view is the only one currently predicting a US recession by the end of 2023. Then again, when it is Wall Street's job to always put lipstick on the bad news pig, it's hardly a surprise. It's also why DB finally stands out from the rest, and for once, in a good way. This is how Folkerts-Landau explains the bank reached its contrarian conclusion:

We set up this "What's in the tails?" series last June, encouraging our analysts to give an alternative to the official house view where we felt there was a well-reasoned and credible alternative scenario. In our first publication that month, I joined my colleagues Peter Hooper and Jim Reid to argue that higher inflation would be the defining macro story of the decade and that the consensus risked missing the paradigm shift. In this latest note in the series we outline how the macro risks are skewed heavily to the downside risk of a significant recession.

In short, DB believes that the scourge of inflation - which most of the bank's peers still have trouble as seeing as anything more than just transitory (even if they finally conceded it in public after claiming it falsely for all of 2021) - has returned and is here to stay. It does so for five reasons:

A number of the structural disinflationary forces that were prevalent in recent decades had begun to shift even before the Covid shock hit. These include a reversal of globalization, shifts in demographics in China, the US, and elsewhere, shifting trends in digital in an inflationary direction, and climate change. As a result of these and other developments, underlying trends in inflation have shifted upwards significantly.

Inflation is now being driven increasingly by rising costs, reflecting strong demand in the face of supply that has been struggling to keep up. The labor market is extremely tight and generally projected to tighten further this year, thanks in part to strong consumer-driven demand and in part to disruptions to labor supply that now seem likely to persist for some time. This means wage inflation, which is already running well above levels consistent with the Fed’s price inflation objective, will be rising further. Supply-chain disruptions that have lifted inflation for many key inputs into production are being exacerbated by the war in Ukraine as well as the Covid-driven disruption of activity in China.

Inflation psychology has shifted dramatically. Despite tremendous increases in costs, profits are doing very well. Sellers have been increasingly willing to pass cost increases along to their customers, and buyers are increasingly willing to absorb those price increases.

While longer-term inflation expectations may still be in the neighborhood of the Fed’s objective, they have generally been rising. More important, historical experience shows that these expectations are strongly influenced by what has been happening to actual inflation recently. Given the likely persistence of higher inflation in the near term, DB expects to see further significant increases in inflation expectations over the year ahead.

Finally, policy measures taken by the Fed as currently envisioned by the markets will be slow to restrain inflation. With inflation remaining anywhere near current levels, the real fed funds rate will remain substantially negative and thereby fail to reach a “restrictive” level, even if balance sheet rundown does more to push up longer-term market rates.

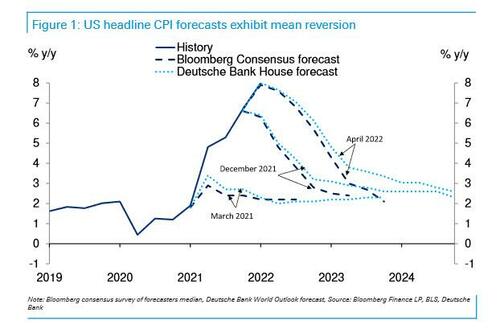

Separately, while we may have seen inflation' highs now - yes, inflation may well have peaked, if mostly due to benign base effects from this point on - it will be a long time before it recedes back to acceptable levels near the Fed’s 2% target.

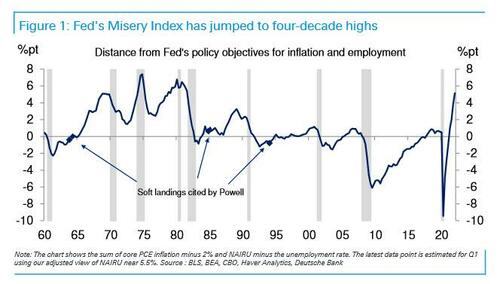

Bottom line, the Fed is far behind the inflationary curve that substantial monetary restraint is needed, far more than the market expects. To drive this point home, DB adopted a quantitative measure that gauges how far the economy has strayed from the Fed's mandates of price stability and maximum sustainable employment. The index in Figure 2 below shows the sum of the amount (in percentage points) by which inflation exceeds the Fed’s 2% target objective plus the amount (in percentage points of unemployment) by which the labor market is estimated to have tightened beyond its sustainable full employment level. DB's strategists call this index the Fed’s “misery index,” given its similarity to the national misery index, which is simply the sum of inflation and unemployment.

Positive readings in the chart above obviously indicate that the Fed has work to do in a tightening direction: inflation is too high and or unemployment has moved too low to be consistent with stable inflation. It is noteworthy that in the past, every time this index has moved noticeably above zero, the economy has gone into recession within a few years as a result of monetary tightening. On this basis, the Fed is currently much further behind the curve than it has been since the early 1980s!

So How much does the Fed have to raise rates and what will be the impact?

Short answer: a lot. So much in fact it will break the market. According to DB, the Fed's first task is to get the fed funds rate back to neutral as quickly as possible. With inflation likely to be elevated well into next year (until the Fed succeeds in slowing things down), the neutral level of the Fed funds rate could well be in the vicinity of 5%. This assumes core PCE inflation will be running not far below 5% over the year ahead (which it won't).

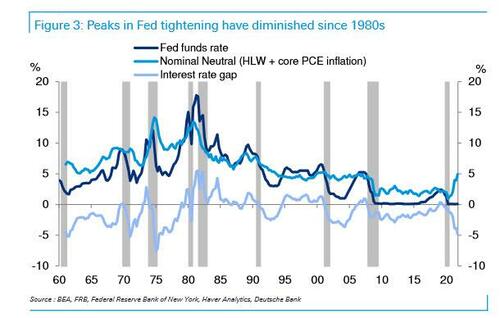

But wait, there's more: after calculating the neutral rate, policymakers have to determine how far above neutral to go to slow the economy enough to bring inflation down. In recent business cycles, the Fed has gone a percentage point or less above neutral, as indicated by the "interest rate gap" in Figure 3 below, which equals the fed funds rate minus an estimate of its neutral level.

The punchline: DB assumes "conservatively" that a fed funds rate moving well into the 5 to 6% range will be sufficient to do the job this time. This is partly because the monetary tightening process will be bolstered by Fed balance sheet reduction, which the bank calculates will be equivalent to a couple additional 25 bp rate hikes. Of course, if the Fed were to follow the prescription of a standard Taylor rule, for example, the fed funds rate could reach double digits. In any event, DB expects that the policy rate hikes, balance sheet reduction, and rising inflation expectations will raise the 10-year Treasury yield to a peak level in the vicinity of 4-1/2 to 5%!

This, needless to say, is troubling because such monetary tightening - and the financial upheaval that accompanies it - will push the economy into a significant recession by late next year. Unemployment is expected to rise several percentage points, although with the labor market already having over-tightened by as much as 2 percentage points of unemployment, "something stronger than a mild recession will be needed to do the job."

That's when the pain ends and the next, mega easing begins: "As the downturn gets under way by late next year, we can see the Fed reversing course and the economy picking up again by mid-2024. Inflation will then gradually recede toward target on the back of increased slack in the labor market and the economy more broadly." In Deutsche's view, "the sooner this process takes place the better."

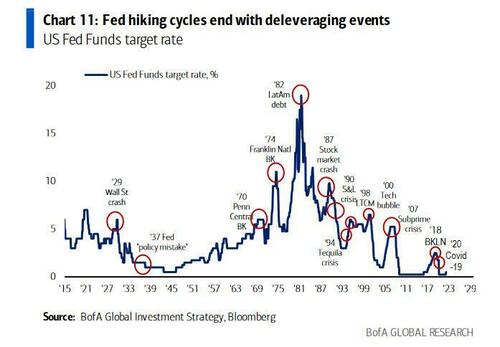

That bank's conclusion is familiar to our readers : the Fed needs to overtighten, and it has never successfully done that without sparking a major crisis, something we addressed most recently over the weekend.

Here it is in the bank' own words: "as it now shifts to a more aggressive tightening stance, the historical record tells us the Fed has never been able to correct even noticeably smaller overshoots of its inflation and employment objectives without pushing the economy into a significant recession. For these reasons, we see the risks of US recession--indeed of the severity of the recession to come--clearly weighted to the upside of consensus expectations."

In short, the Fed will keep pushing until something breaks... and judging by today's market crash that day may be sooner than most think.

The full DB report is available to professional subs in the usual place.

Aucun commentaire:

Enregistrer un commentaire